GST Simplified

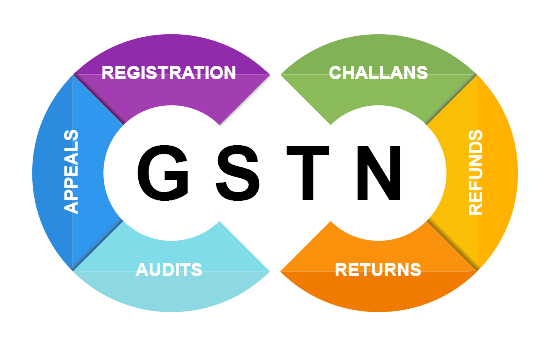

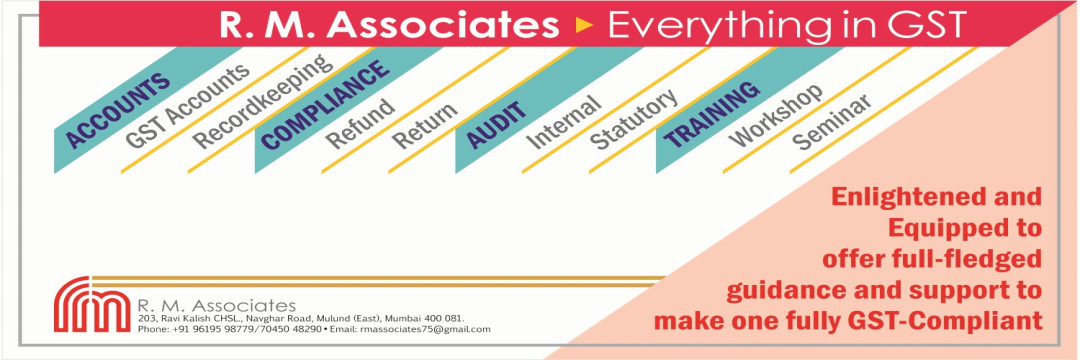

GST e-Services is formed with a clear and definite goal of providing an user-friendly and easy-to-understand Goods & Services Tax (GST), a new indirect tax levy which rolled out with effect from 01.07.2017.

GST Simplified

GST e-Services is formed with a clear and definite goal of providing an user-friendly and easy-to-understand Goods & Services Tax (GST), a new indirect tax levy which rolled out with effect from 01.07.2017.